|

Update on ROII’s 2024 Refund Distribution

As 2024 re-enrollment notices are issued, we find that many companies have questions about the upcoming ROII refund distribution. Below outlines what ROII will be disbursing this Spring:

ROII will be distributing the 1st refund adjustment for the 2022 plan year, which represents the 25% pro-rata share of the refund (usually 6% - 8% of standard premium) – the remaining 75% performance share will be distributed in the Spring of 2026. We are also distributing the final performance share of the refund for the 2020 plan year – the pro-rata share was distributed previously in the Spring of 2022. ROII participants enrolled in these plan years who have a loss ratio below 0.792 (developed claim costs divided by standard premium) should have a check. L&I will perform their 2024 adjustment at the end of April, and ROII should have check amounts available in early-May.

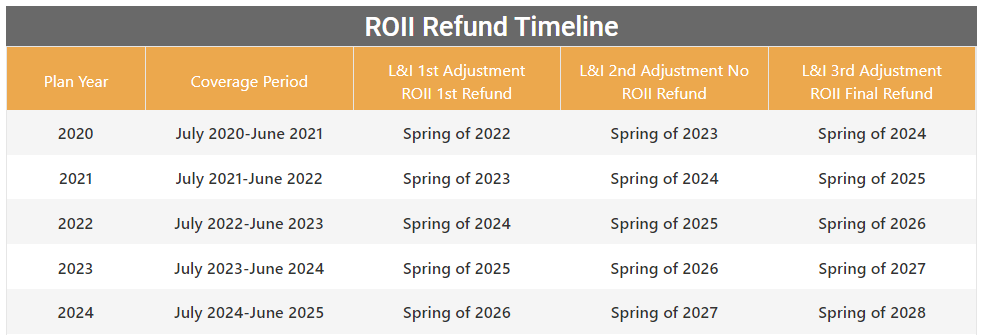

Below is a timeline of the refund distribution starting with the 2020 plan year and running through the 2024 plan year, which begins July 1, 2023.

Refunds based on 25% pro-rata 75% performance:

1st refund-distributes all of the 25% pro-rata share

3rd and final refund-distributes all of the 75% performance

NOTE: NO refund distributed for 2nd adjustment

*To qualify for a refund, companies must have a loss ratio (Developed Losses divided by Standard Premium) below 0.792 for the plan year.

If you have questions about the refunds, you can contact ROII Director, jennk@biaw.com.

|